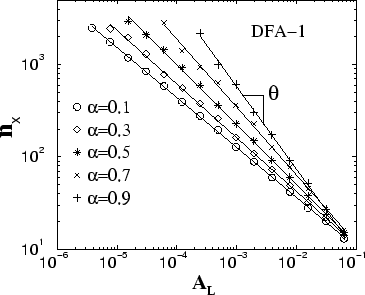

Table I: The crossover exponent  from the power-law relation between the

crossover scale from the power-law relation between the

crossover scale  and the slope of the linear trend and the slope of the linear trend  --

--

--for different values

of the correlation exponents --for different values

of the correlation exponents  of the noise

[Fig. 3]. The values of of the noise

[Fig. 3]. The values of  obtained from our

simulations are in good agreement with the analytical prediction obtained from our

simulations are in good agreement with the analytical prediction

[Eq. (9)]. Note that [Eq. (9)]. Note that  are not always

exactly equal to are not always

exactly equal to  because because

in simulations is not a

perfect simple power-law function and the way we determine numerically in simulations is not a

perfect simple power-law function and the way we determine numerically

is just approximated. is just approximated.

|

|

|

| 0.1 |

-0.54 |

-0.53 |

| 0.3 |

-0.58 |

-0.59 |

| 0.5 |

-0.65 |

-0.67 |

| 0.7 |

-0.74 |

-0.77 |

| 0.9 |

-0.89 |

-0.91 |

|