Next: Noise with linear

trends Up: Effect

of Trends on Previous: Introduction

Method

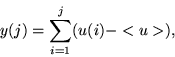

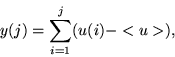

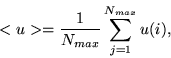

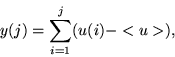

To illustrate the DFA method, we consider a noisy time series,  (

(  ). We integrate the time series

). We integrate the time series  ,

,

|

(1) |

where

|

(2) |

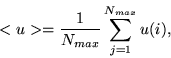

and is divided into boxes of equal size,  . In each box, we

fit the integrated time series by using a polynomial function,

. In each box, we

fit the integrated time series by using a polynomial function,  , which is called the local trend. For order-

, which is called the local trend. For order- DFA (DFA-1 if

DFA (DFA-1 if  , DFA-2 if

, DFA-2 if  etc.),

etc.),  order polynomial function

should be applied for the fitting. We detrend The integrated time

series,

order polynomial function

should be applied for the fitting. We detrend The integrated time

series,  by subtracting the local trend

by subtracting the local trend  in each box, and we calculate the detrended

fluctuation function

in each box, and we calculate the detrended

fluctuation function

|

(3) |

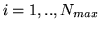

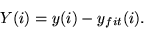

For a given box size  , we calculate the root mean

square (rms) fluctuation

, we calculate the root mean

square (rms) fluctuation

![\begin{displaymath}

F(n) =\sqrt{\frac{1}{N_{max}}\sum\limits_{i=1}^{N_{max}}\left [Y(i)\right ]^2}

\end{displaymath}](img167.png) |

(4) |

The above computation is repeated for box sizes  (different scales) to provide a relationship between

(different scales) to provide a relationship between  and

and  . A power-law relation between

. A power-law relation between  and the box

size

and the box

size  indicates the presence of scaling:

indicates the presence of scaling:  . The parameter

. The parameter  ,

called the scaling exponent or correlation exponent, represents the

correlation properties of the signal: if

,

called the scaling exponent or correlation exponent, represents the

correlation properties of the signal: if  , there

is no correlation and the signal is an uncorrelated signal (white

noise); if

, there

is no correlation and the signal is an uncorrelated signal (white

noise); if  , the signal is anticorrelated;

if

, the signal is anticorrelated;

if  , there are positive

correlations in the signal.

, there are positive

correlations in the signal.

Next: Noise with linear

trends Up: Effect

of Trends on Previous: Introduction

Zhi Chen 2002-08-28