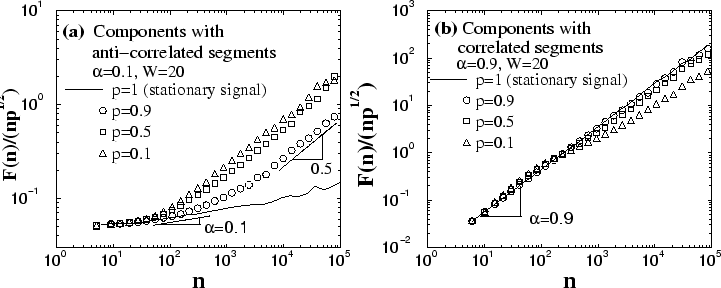

For components containing segments with anti-correlations (

First, we study how the correlation properties of the components depend on

the fraction ![]() of the segments with identical local correlations.

of the segments with identical local correlations.

For components containing segments with anti-correlations (![]() )

and fixed size

)

and fixed size ![]() [Fig. 5(b)], we find a crossover to random behavior (

[Fig. 5(b)], we find a crossover to random behavior (![]() ) at

large scales, which becomes more pronounced (shift to smaller scales) when

the fraction

) at

large scales, which becomes more pronounced (shift to smaller scales) when

the fraction ![]() decreases [Fig. 6(a)]. At small scales

(

decreases [Fig. 6(a)]. At small scales

(![]() ), the slope of

), the slope of

![]() is identical to that expected for a stationary signal

is identical to that expected for a stationary signal ![]() (i.e.,

(i.e., ![]() ) with the same anti-correlations [solid line in

Fig. 6(a)]. Moreover, we observe a vertical shift in

) with the same anti-correlations [solid line in

Fig. 6(a)]. Moreover, we observe a vertical shift in ![]() to

lower values when the fraction

to

lower values when the fraction ![]() of non-zero anti-correlated segments

decreases. We find that at small scales after rescaling

of non-zero anti-correlated segments

decreases. We find that at small scales after rescaling ![]() by

by

![]() , all curves collapse on the curve for the stationary

anti-correlated signal

, all curves collapse on the curve for the stationary

anti-correlated signal ![]() [Fig. 6(a)]. Since at small scales

(

[Fig. 6(a)]. Since at small scales

(![]() ) the behavior of

) the behavior of ![]() does not depend on the segment size

does not depend on the segment size ![]() ,

this collapse indicates that the vertical shift in

,

this collapse indicates that the vertical shift in ![]() is due only to

the fraction

is due only to

the fraction ![]() . Thus, to determine the fraction

. Thus, to determine the fraction ![]() of anti-correlated

segments in a nonstationary signal [mixture of anti-correlated and correlated

segments, Fig. 5(a)] we only need to estimate at small scales the

vertical shift in

of anti-correlated

segments in a nonstationary signal [mixture of anti-correlated and correlated

segments, Fig. 5(a)] we only need to estimate at small scales the

vertical shift in ![]() between the mixed signal [Fig. 5(d)] and a stationary signal

between the mixed signal [Fig. 5(d)] and a stationary signal ![]() with identical anti-correlations. This approach is valid for

nonstationary signals where the fraction

with identical anti-correlations. This approach is valid for

nonstationary signals where the fraction ![]() of the anti-correlated

segments is much larger than the fraction of the correlated segments in the

mixed signal [Fig. 5(a)], since only under this condition the

anti-correlated segments can dominate

of the anti-correlated

segments is much larger than the fraction of the correlated segments in the

mixed signal [Fig. 5(a)], since only under this condition the

anti-correlated segments can dominate ![]() of the mixed signal at small

scales [Fig. 5(d)].

of the mixed signal at small

scales [Fig. 5(d)].

|

For components containing segments with positive correlations

(![]() ) and fixed size

) and fixed size ![]() [Fig. 5(c)], we observe a similar behavior for

[Fig. 5(c)], we observe a similar behavior for ![]() , with collapse

at small scales (

, with collapse

at small scales (![]() ) after rescaling by

) after rescaling by ![]() [Fig. 6(b)] (For

[Fig. 6(b)] (For ![]() , there are

exceptions with different rescaling factors, see

Appendix 7.2). At small scales the values of

, there are

exceptions with different rescaling factors, see

Appendix 7.2). At small scales the values of ![]() for

components containing segments with positive correlations are

much larger compared to the values of

for

components containing segments with positive correlations are

much larger compared to the values of ![]() for components containing an

identical fraction

for components containing an

identical fraction ![]() of anti-correlated segments

[Fig. 6(a)]. Thus, for a mixed signal where the fraction of

correlated segments is not too small (e.g.,

of anti-correlated segments

[Fig. 6(a)]. Thus, for a mixed signal where the fraction of

correlated segments is not too small (e.g., ![]() ), the contribution at

small scales of the anti-correlated segments to

), the contribution at

small scales of the anti-correlated segments to ![]() of the

mixed signal [Fig. 5(d)] may not be observed, and the behavior (values

and slope) of

of the

mixed signal [Fig. 5(d)] may not be observed, and the behavior (values

and slope) of ![]() will be dominated by the correlated segments. In this

case, we must consider the behavior of

will be dominated by the correlated segments. In this

case, we must consider the behavior of ![]() of the mixed signal at

large scales only, since the contribution of the anti-correlated segments at

large scales is negligible. Hence, we next study the scaling behavior of

components with correlated segments at large scales.

of the mixed signal at

large scales only, since the contribution of the anti-correlated segments at

large scales is negligible. Hence, we next study the scaling behavior of

components with correlated segments at large scales.

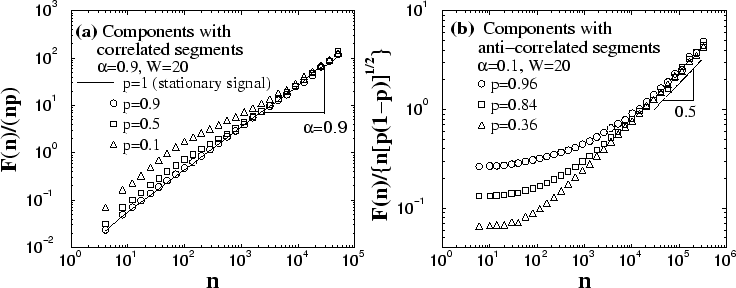

For components containing segments with positive correlations

and fixed size ![]() [Fig. 5(c)], we find that at large scales

the slope of

[Fig. 5(c)], we find that at large scales

the slope of ![]() is identical to that expected for a stationary

signal

is identical to that expected for a stationary

signal ![]() (i.e.,

(i.e., ![]() ) with the same correlations [solid line in

Fig. 7(a)]. We also observe a vertical shift in

) with the same correlations [solid line in

Fig. 7(a)]. We also observe a vertical shift in ![]() to lower

values when the fraction

to lower

values when the fraction ![]() of non-zero correlated segments in the

component decreases. We find that after rescaling

of non-zero correlated segments in the

component decreases. We find that after rescaling ![]() by

by ![]() , at large

scales all curves collapse on the curve representing the stationary

correlated signal

, at large

scales all curves collapse on the curve representing the stationary

correlated signal ![]() [Fig. 7(a)]. Since at large scales (

[Fig. 7(a)]. Since at large scales (![]() ), the effect of the zero

segments of size

), the effect of the zero

segments of size ![]() on the r.m.s. fluctuation function

on the r.m.s. fluctuation function ![]() for

components with correlated segments is negligible, even when the zero

segments are 50% of the component [see Fig. 7(a)], the finding of a collapse

at large scales indicates that the vertical shift in

for

components with correlated segments is negligible, even when the zero

segments are 50% of the component [see Fig. 7(a)], the finding of a collapse

at large scales indicates that the vertical shift in ![]() is only due to

the fraction

is only due to

the fraction ![]() of the correlated segments. Thus, to determine the fraction

of the correlated segments. Thus, to determine the fraction

![]() of correlated segments in a nonstationary signal (which is a mixture of

anti-correlated and correlated segments [Fig. 5(a)]), we only need to

estimate at large scales the vertical shift in

of correlated segments in a nonstationary signal (which is a mixture of

anti-correlated and correlated segments [Fig. 5(a)]), we only need to

estimate at large scales the vertical shift in ![]() between the mixed signal

[Fig. 5(d)] and a stationary signal

between the mixed signal

[Fig. 5(d)] and a stationary signal ![]() with identical

correlations.

with identical

correlations.

|

For components containing segments with anti-correlations and fixed size ![]() [Fig. 5(b)], we find that at large scales in order to collapse the

[Fig. 5(b)], we find that at large scales in order to collapse the

![]() curves (

curves (![]() ) [Fig. 6(a)] we need to rescale

) [Fig. 6(a)] we need to rescale ![]() by

by ![]() [see Fig. 7(b)]. Note that there is a difference

between the rescaling factors for components with anti-correlated and

correlated segments at small [Figs. 6(a-b)] and large

[Figs. 7(a-b)] scales. We also note that for components with

correlated segments (

[see Fig. 7(b)]. Note that there is a difference

between the rescaling factors for components with anti-correlated and

correlated segments at small [Figs. 6(a-b)] and large

[Figs. 7(a-b)] scales. We also note that for components with

correlated segments (![]() ) and sufficiently small

) and sufficiently small ![]() , there is a

different rescaling factor of

, there is a

different rescaling factor of ![]() in the intermediate scale

regime [see Appendix 7.2, Fig. 10].

in the intermediate scale

regime [see Appendix 7.2, Fig. 10].

For components containing segments of white noise (![]() ), we find no

change in the scaling exponent as a function of the fraction

), we find no

change in the scaling exponent as a function of the fraction ![]() of the

segments, i.e.,

of the

segments, i.e., ![]() for the components at both small and large

scales. However, we observe at all scales a vertical shift in

for the components at both small and large

scales. However, we observe at all scales a vertical shift in ![]() to

lower values with decreasing

to

lower values with decreasing ![]() :

:

![]() .

.